The U.S. economic system is in a medically-induced coma. Unemployment is hovering. Companies are teetering on the brink of chapter. It is unclear when our lives will return to their pre-pandemic state.

One factor appears obvious: As folks lose jobs and medical insurance, Medicaid enrollment will leap, maybe by as a lot as 20% to 30%. This could have profound implications for the drug channel.

Today, I concentrate on how this enhance will have an effect on retail pharmacies and pharmacy profit managers (PBMs). Below, I evaluation Medicaid enrollment developments, how states handle prescriptions, and the components driving the coming growth in Medicaid enrollment.

As I clarify, many (however not all) retail pharmacies will profit from Medicaid progress. PBMs, nevertheless, won’t fare as properly. Read on and see in case you agree.

Most of the Medicaid market data on this article is tailored from our new 2020 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

If you will have the report and need to be taught extra, try the following materials:

- Section 4.1.1.

- Section 8.4.

- Section 9.1.3.

- Section 11.2.3.

- Section 11.2.5.

MEDICAID ENROLLMENT TODAY

The chart under reveals the ongoing progress in Medicaid enrollment over the previous 15 years.

Two major components have elevated Medicaid enrollment since 2007:

- Recession: The nice recession of 2008 to 2009 elevated Medicaid enrollment by 13.5 million folks (+30%), from 45.6 million in the pre-recession interval to 59.1 million folks in 2013.The earlier recession additionally corresponded to a decline in the variety of folks with employer-sponsored insurance coverage. This determine fell from 179.Three million in 2007 to 167.Three million folks in 2011, and then started rising. In 2019, employers supplied insurance coverage protection for 175 million folks.

- The Affordable Care Act (ACA): Beginning in 2014, the ACA expanded eligibility to just about all non-elderly adults with revenue at or under 138% of the federal poverty degree. Enrollment has elevated by 15 million folks (+25%), from 59.1 million in the pre-expansion interval to 74.1 million in 2019. Consequently, Medicaid has develop into the fastest-growing supply of insurance coverage protection in the United States.

States have flexibility in how they administer the Medicaid program. For pharmaceuticals, a state can select to reimburse pharmacies immediately for filling prescriptions for Medicaid beneficiaries on a fee-for-service foundation. Alternatively, the state can depend on Managed Medicaid (managed care organizations that function beneath capitated preparations).

Most states have each fee-for-service and managed care applications inside their states. However, managed care plans accounted for 71% of Medicaid’s whole distributed prescriptions in 2018. Managed care’s share varies by state. (See MACPAC’s MACStats data).

As I clarify under, the fee-for-service vs. managed care distinction is essential to understanding the affect of Medicaid enrollment progress.

THE COMING MEDICAID BOOM

The financial dislocation from COVID-19 has been and will proceed to be excessive. It’s not clear how deep the recession will likely be or how lengthy it should final.

Here’s one believable outlook for Medicaid enrollment: Health Management Associates (HMA) estimates that the COVID-19 financial downturn will in the end enhance Medicaid enrollment from 82 million (+11%) to 94 million (+27%). HMA’s intermediate forecast initiatives that Medicaid enrollment will develop by 17 million folks, to 88 million. See the complete HMA report for more details about its projections.

PHARMACY IMPACT

Most pharmacies will profit from Medicaid enlargement. What’s extra, some states are reevaluating their managed care relationships due to new disclosures about PBM compensation from community spreads in Medicaid. The modifications in how states function their Medicaid applications will enhance the variety of pharmacies that will profit.

The revenue outlook from rising Medicaid enrollment for a pharmacy relies upon largely on whether or not it operates in a state that reimburses prescriptions utilizing fee-for-service or by way of managed care. That’s as a result of pharmacies earn increased gross earnings from prescriptions paid beneath fee-for-service Medicaid reimbursement than the gross earnings they earn from these paid beneath managed care.

I delve deeply into this problem in chapters 8 and 11 of our new report. Briefly:

- A pharmacy’s business and Medicaid managed care reimbursement for generic medicine is normally set by a PBM-determined most allowable value (MAC). On common, pharmacies will earn constructive prescription gross margins. However, a pharmacy can typically earn a low margin and even lose cash on a prescription.PBM reimbursement to pharmacies is very controversial and has prompted varied state legal guidelines that try to make sure that pharmacies are usually not paid lower than their acquisition prices. During 2020, these legal guidelines will likely be topic to new scrutiny by the U.S. Supreme Court, which may rule on whether or not states have the authority to manage sure facets of PBM conduct. The case—Rutledge v. Pharmaceutical Care Management Association—is predicated on an Arkansas legislation that regulates PBMs’ reimbursements to pharmacies. (Arguments in the case have been delayed due to the coronavirus shutdown.)

- Federal rules require fee-for-service state Medicaid applications to reimburse pharmacies based mostly on an acquisition value survey benchmark. (See my 2016 analysis of the infamous AMP final rule.) These surveys overestimate a pharmacy’s precise, confidential web acquisition prices. In addition, pharmacies are additionally paid a state-determined skilled allotting price that averages $10 to $12 per prescription.

Thus, the fee-for-service acquisition value method supplies a pharmacy with a steady common gross revenue per prescription. Note that a pharmacy’s marginal (incremental) value of allotting one additional script is decrease than its common value of allotting, which boosts prescription profitability. (Refresh your memory with my 2012 article on pharmacy economics 101.)

The excellent news for pharmacies: Fee-for-service is gaining popularity. The dangerous information: Pharmacies in states with managed care might even see reimbursement drop as Medicaid enrollment will increase. For retail chains, the web affect will rely on the place their shops are positioned.

PBM IMPACT

PBMs will expertise decrease earnings from a leap in Medicaid enrollment. I see at the least three damaging results:

One, Medicaid enrollment progress will come at the expense of its business employer-sponsored insurance coverage, which is extra worthwhile to a PBM and its affiliated insurer than its Medicaid enterprise. Some folks will sadly develop into uninsured, which implies these prescriptions will drop out of the PBM system.

Two, PBM compensation fashions in Medicaid have shifted, as a consequence of elevated scrutiny by payers, regulators, and politicians.

PBMs don’t retain any of the statutorily decided rebates beneath the Medicaid Drug Rebate Program. Consequently, states compensate PBMs utilizing a mixture of administrative charges and retail community spreads, a.ok.a., unfold pricing. With unfold pricing, plan sponsors compensate the PBM by allowing the PBM to retain variations, or spreads, between (a) the quantity that a PBM costs to a Medicaid plan, and (b) the quantity that the PBM pays to the pharmacy that dispenses the drug to a Medicaid beneficiary.

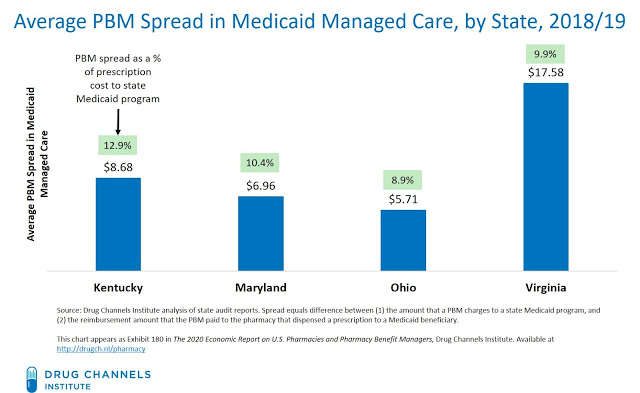

Surprising new details about PBMs’ unfold pricing earnings in Managed Medicaid has emerged over the previous two years. Below, I reproduce Exhibit 180 from our new report. It reveals the outcomes of audits in 4 states: Kentucky, Maryland, Ohio, and Virginia. PBMs added a mean of $6 to $18 per Medicaid prescription above the quantities paid to pharmacies.

The scrutiny and disclosure of those spreads have began to alter some states’ contracting practices. Many states are shifting from unfold pricing to pass-through agreements with an administrative price. Last week, New York turned the newest state to carve out pharmacy advantages from Medicaid managed care. It adopted such states as Ohio and West Virginia in switching pharmacy reimbursement to Medicaid fee-for-service quantities.

A 3rd damaging impact arises from disruption to a PBM’s allotting earnings from the 340B Drug Pricing Program. (You didn’t assume I’d neglect 340B, did you?)

In a sequence of articles final summer season, I documented how the greatest PBM-owned specialty pharmacies take part as contract pharmacies inside the 340B program. These specialty pharmacies are in a position to share in the 340B reductions that lined entities earn. Gross earnings may be $1,000 per prescription—far exceeding a pharmacy’s typical earnings from allotting a third-party-paid prescription. See Here’s How PBMs and Specialty Pharmacies Snag Super-Size Profits from the 340B Program.

However, the 340B statute prohibits producers from having to supply a reduced 340B value and a Medicaid drug rebate for the identical drug. The prohibition on duplicate reductions applies to conventional Medicaid preparations in addition to Medicaid applications operated by managed care organizations. Consequently, a shift from business insurance coverage to Medicaid will cut back the variety of prescriptions eligible for the 340B contract pharmacy course of.

Note that producers gained’t essentially profit from this transformation. That’s as a result of the greenback worth of a drug’s gross-to-net discount will circulation to states in the type of a Medicaid rebate, as a substitute of flowing to suppliers as a 340B low cost that may be shared with a PBM’s pharmacy.

WHAT’S NEXT?

This article solely describes a few of the preliminary results of the coming Medicaid enlargement. For extra, please join me for my upcoming live video webinars.

I’ll share DCI’s newest market knowledge and developments from The 2020 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers. Topics will embrace:

- How will medical insurance markets change

- What will occur to pharmacy and PBM earnings

- Business implications for prescription demand and the drug channel

- Impacts on the 340B Drug Pricing Program

- Whether short-term modifications in pharmacy and buy-and-bill markets will persist

- What’s subsequent for federal and state drug pricing laws

- How the pandemic will have an effect on prospects for brand spanking new business entrants, together with Amazon and venture-capital-backed pharmacies

- And extra!

CLICK HERE to submit questions to me in advance of the events.

Stay secure, everybody!