USDA’s insurance coverage merchandise have confirmed profitable for crop farmers. Often offering a lifeline after pure disasters. Yet, for all its successes there has by no means been a broadly used product to assist cattle producers handle worth danger. That might be altering because of latest enhancements to Livestock Risk Protection (LRP) plan of insurance coverage.

What is LRP?

LRP protects producers from surprising worth declines. It permits producers to insure their cattle primarily based upon anticipated market costs and protects them if costs fall unexpectedly.

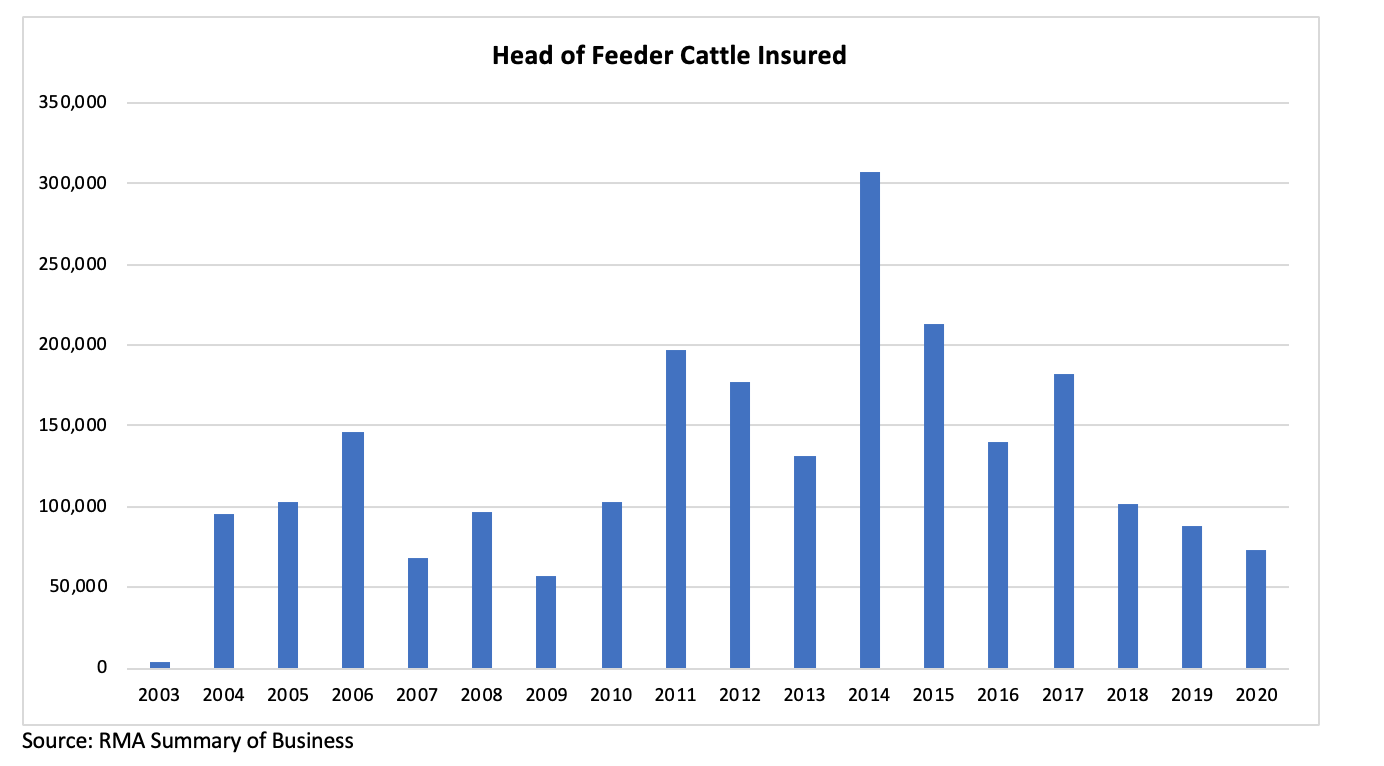

LRP permits producers to insure between 70% and 100% of the projected worth of their cattle. The projected worth is predicated upon feeder cattle or stay cattle futures costs and will differ relying upon the kind of cattle (e.g., steers or heifers) and the load of the cattle. The insurance coverage protection may be matched to the time that the cattle would sometimes be offered. LRP gives protection for cow/calf, stocker, and feedlot operations. LRP has been obtainable since 2003, however participation remained low because of perceived value and different points akin to lack of choices to insure additional forward than a few months.

Recent Improvements

Recent Improvements

On July 1 2019, USDA carried out important enhancements to LRP and has lately introduced that extra enhancements can be efficient on July 1st of this yr. Changes which have and can quickly happen embody:

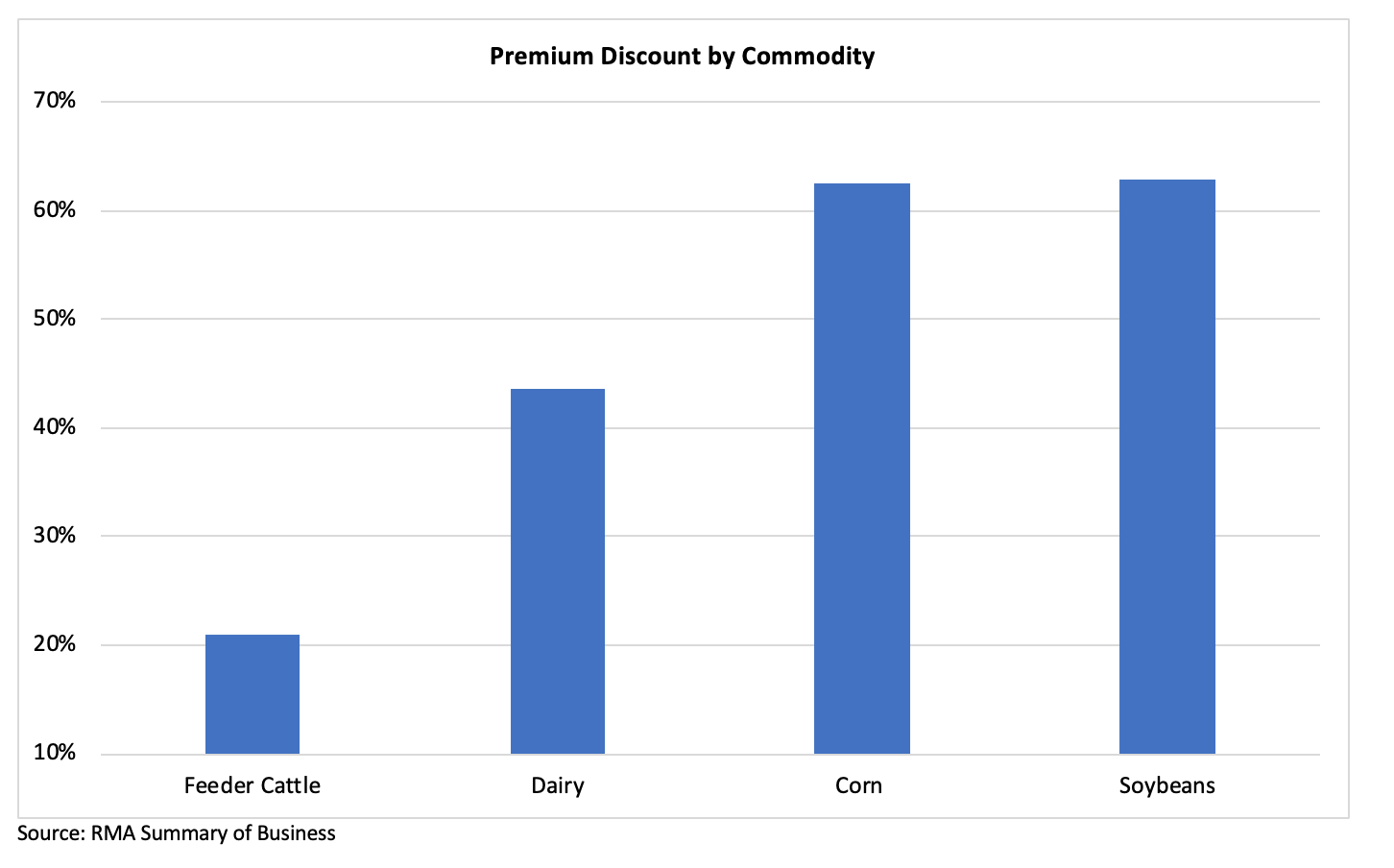

- Affordability: Reducing value by rising the premium low cost from 13-25% for the very best ranges of protection and even increased for coverages with over a 5% deductible;

- Delayed Premium: Allowing premium to be paid after the insurance coverage protection ends; and

- Head Limits: Increasing the variety of head that may be insured.

Together these adjustments make LRP considerably extra interesting to producers. While premiums nonetheless must be decreased, it’s essential to notice that at the moment’s LRP isn’t the LRP of previous.

Additional Potential Changes

In August USDA’s Federal Crop Insurance Board of Directors will as soon as once more take into account additional enhancements to LRP. When figuring out whether or not to make adjustments to an insurance coverage program, producer help is likely one of the key standards that’s thought-about. Cattle producers who’re excited by improved danger administration choices ought to electronic mail Applied Analytics (info at backside) to find out about efforts underway to proceed to enhance LRP. If accepted, these adjustments will present cattle producers an inexpensive device to allow them to higher shield themselves in at the moment’s unstable markets.

Bottom-Line

LRP is a much-improved program. Today it’s extra inexpensive and has super flexibility. While USDA must proceed bettering LRP – in at the moment’s unstable market it’s value a re-examination.