Last Friday’s Executive Orders revived the federal government’s effort to reform rebates in federal applications. Whether that effort succeeds, at present’s replace reminds us what’s nonetheless at stake in reforming rebates throughout the U.S. drug channel.

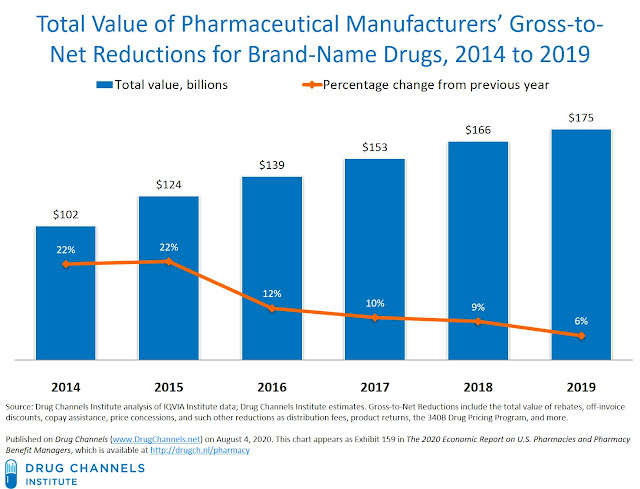

For 2019, Drug Channels Institute estimates that the gross-to-net bubble—the greenback hole between gross sales at brand-name medicine’ listing costs and their gross sales at web costs after rebates and different reductions—reached $175 billion.

The bubble displays—and drives—a lot of sufferers’ issues and misunderstandings of U.S. drug costs.

However, the political and sensible challenges to rebate reform stay daunting. Few folks grasp the complicated financial interaction of affected person out-of-pocket spending, cost-shifting, premiums, and payer incentives.

Despite the pandemic, I stay hopeful that we can assist this bubble pop.

DRUG PRICING FAQs

Here are some regularly requested questions that will help you higher perceive pricing and its implications.

1. What are gross and web drug costs?

The producer of a drug establishes the drug’s listing (gross) worth, which is named the Wholesale Acquisition Cost (WAC). A drug’s web worth equals its listing worth minus all rebates, reductions, and costs.

The main parts of those gross-to-net worth variations for brand-name medicine embody:

- Rebates to business payers

- Rebates to Medicare Part D plans

- Rebates to the Medicaid program

Consequently, brand-name producers earn considerably much less income than drug listing costs suggest, as a result of gross-to-net distinction between a producer’s listing and web costs. That’s additionally why web drug costs are declining whilst listing costs develop. See Surprise! Brand-Name Drug Prices Fell in 2019. I’ll replace the obtainable manufacturer-specific information in an upcoming put up.

2. What is the gross-to-net bubble?

Drug Channels Institute coined the time period gross-to-net bubble to explain the pace and dimension of progress in the entire greenback worth of producers’ gross-to-net reductions.

A producer’s gross revenues equal its revenues from gross sales at a drug’s WAC listing worth. Net revenues equal its revenues from gross sales at a drug’s web worth, i.e., the precise revenues acquired and reported by the producer after rebates, reductions, and different reductions listed above. Negotiated and statutory rebates to third-party payers are the biggest and most vital parts of gross-to-net variations.

Our terminology has been embraced by trade individuals, the federal government, and others who cowl the trade. In reality, the Medicare Payment Advisory Commission (MedPAC) used the time period in its June 2019 Report to Congress.

Click here to read all Drug Channels articles on the bubble.

We additionally personal the tremendous cool area title www.GrossToNetBubble.com, which redirects to our most up-to-date article on the bubble’s dimension.

3. What does this need to do with SpongeBob SquarePants?

OUR BUBBLE BUDDY

The compounding impact of gross-to-net pricing variations signifies that the entire worth of producers’ off-invoice reductions, rebates, and different worth concessions for brand-name medicine preserve increasing. We estimate that in 2019, the entire worth of gross-to-net reductions for brand-name medicine was $175 billion. We first printed the 2019 determine in our 2020 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers, launched final March.

As the listing worth of a producer’s merchandise rises, the greenback worth of the producer’s rebates and reductions grows. The producer additionally gives bigger rebates to offset the rise in listing costs. Hence, the entire worth of the gross-to-net bubble expanded by about $9 billion (+6%) in 2019, regardless of the slowing growth in list prices and the negative growth rates for net prices. However, the entire worth of rebates and reductions grew on the slowest fee in current years.

Exhibit 160 of our 2020 pharmacy/PBM report summarizes our estimates of the key parts of the gross-to-net bubble for brand-name medicine in 2019. We estimate that about two-thirds of complete gross-to-net reductions comes from rebates paid to third-party payers.

SOAPY WATERS

As longtime readers know, Drug Channels has typically delved into the gross-to-net bubble’s important impression on sufferers.

Here are two of essentially the most pernicious issues:

- Seniors with Part D protection pay greater than they need to. A affected person’s development by way of the Part D profit tiers is predicated on the prescription worth negotiated between the plan and the pharmacy. That negotiated worth excludes rebates, so beneficiaries attain catastrophic protection—and its unbounded 5% out-of-pocket expense—sooner when utilizing merchandise with increased listing costs.Payers and PBMs have incentives to pick out higher-priced, closely rebated medicine as an alternative of lower-cost alternate options. That’s one purpose Part D plans require enrollees to make use of merchandise with increased listing costs over equal medicine with decrease listing costs. (See Why Part D Plans Prefer High List Price Drugs That Raise Costs for Seniors.) Manufacturers usually are not permitted to supply copayment assist to beneficiaries of federal healthcare applications. Therefore, the burden of utilizing a higher-price product is borne fully by the affected person.

This dynamic explains why it’s so onerous to implement rebate reform in Part D. Stand-alone Part D plans have restricted flexibility to soak up the removing of rebates. In different phrases, the premiums for a majority of Part D beneficiaries are artificially diminished by asking about one-third of the sickest seniors to pay inflated out-of-pocket prices.

Let’s hope we are able to have trustworthy, fact-based conversations to handle these points. Perhaps a phased-in and focused method may jumpstart the system’s evolution, as I recommend in my analysis of Trump’s Executive Orders.