It’s time for our annual Drug Channels examination of PBM drug spending reviews. For 2019, we once more goal our magnifying glass on the annual pattern reviews from the biggest pharmacy profit managers (PBMs): CVS Health, Express Scripts, and Prime Therapeutics. (See their report hyperlinks under.)

Once once more, we discover that business drug spending didn’t race greater—opposite to what you retain listening to from journalists and politicians. Spending rose by lower than 3% in 2019, persevering with a multiyear pattern of sluggish development. At some plan sponsors, whole drug spending even declined. For specialty medicine, greater utilization—not drug prices—was once more the largest issue driving specialty spending development.

Notably, purchasers of Prime Therapeutics fared worse than these of Express Scripts and CVS Caremark. Below, I clarify three elements behind Prime’s underperformance. Its third place end highlights why the PBM business continues to consolidate.

START YOUR ENGINES!

As all the time, I encourage you to overview the supply supplies for your self. Here are hyperlinks to the PBMs’ 2019 drug pattern reviews:

A couple of feedback on these information:

- Our comparability focuses solely on business payers: employers and well being plans. Those are the one information reported by all three PBMs. Express Scripts supplied separate pattern figures for Medicare, Medicaid (excluding statutory rebates), and Exchanges. Prime Therapeutics supplied separate pattern information for Medicare and Medicaid (excluding statutory rebates).

- These reviews are stuffed with attention-grabbing numbers, however they’re primarily advertising paperwork, not peer-reviewed analysis research. I imagine that the information are roughly comparable among the many reviews, regardless of some methodological variations.

- MedImpact plans to launch its report inside a month or so. The different giant PBMs—Anthem (IngenioRx), Humana, and OptumRx (UnitedHealth)—present no public transparency into their efficiency. Sorry, no participation trophies this time!

SLOWDOWN

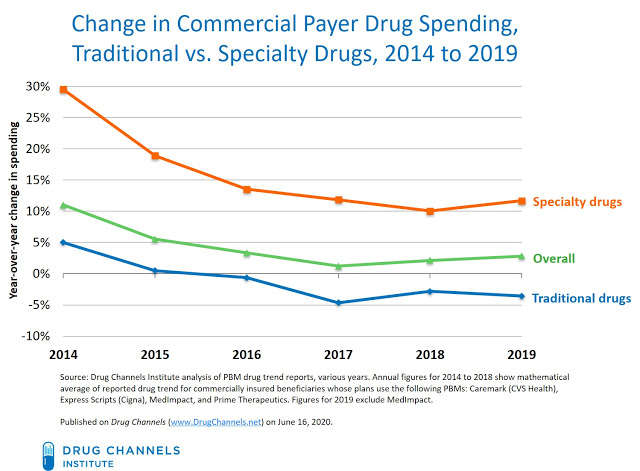

The chart under reveals the unweighted common drug pattern figures over the previous six years. As you’ll be able to see, drug spending continues to develop extra slowly than each different a part of the U.S. healthcare system.

[Click to Enlarge]

These information present a fairly complete image of the general business payer market. The three PBMs included in the 2019 computation accounted for about 60% of professional forma U.S. retail, mail, long-term care, and specialty equal prescription claims in 2019. See Exhibit 88 in our 2020 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

The information additionally echo the numbers from the federal government’s National Health Expenditure Accounts. See Latest CMS Data: Drug Spending is Not Skyrocketing; Hospitals and Physicians Dominate Healthcare Costs.

WINNER’S CIRCLE

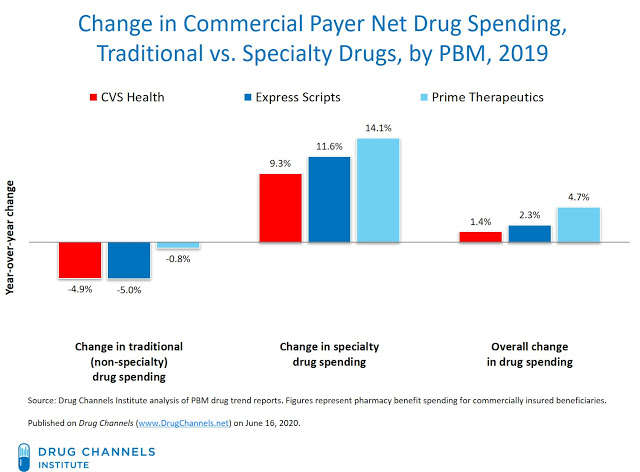

The chart under summarizes the reported 2019 business drug pattern figures from every of the three PBMs thought-about in this text: the Caremark enterprise of CVS Health; the Express Scripts enterprise of Cigna; and Prime Therapeutics. The PBM reviews are the one public sources that distinguish between spending on conventional medicine and spending on specialty medicine.

[Click to Enlarge]

The PBMs’ information spotlight key traits about drug spending:

- For 2019, CVS and Express Scripts reported total adjustments in drug spending that had been in the low single digits. Prime reported mid-single-digit development in total drug spending.

- Spending development on conventional medicine declined by mid-single digits for the third consecutive 12 months. This decline got here from deeper business rebates on brand-name medicine, ongoing deflation in generic medicine, and a small improve in the generic meting out charges.

- The outcomes for CVS and Express Scripts had been comparable. For CVS Caremark’s business purchasers, web drug costs for conventional medicine declined by -6.3%, whereas utilization grew by 1.5%. For Express Scripts’ business purchasers, web drug costs for conventional medicine declined by -6.4%, whereas utilization grew by 1.4%.

SPECIALTY FUEL

The total spending figures don’t inform the entire story. That’s as a result of year-over-year adjustments in drug spending have two main parts:

- Unit prices—the payer’s price per unit of remedy. Unit prices fluctuate with:

- the speed of inflation in brand-name drug costs

- shifts to completely different drug choices inside a therapeutic class

- a shift in mixture of therapeutic lessons utilized by beneficiaries

- the substitution of generic medicine for brand-name medicine

- Utilization—the full amount of medication obtained by a payer’s beneficiaries. Utilization varies with:

- the variety of individuals on drug remedy

- the diploma to which they adhere to their drug remedy

- the typical variety of days of remedy

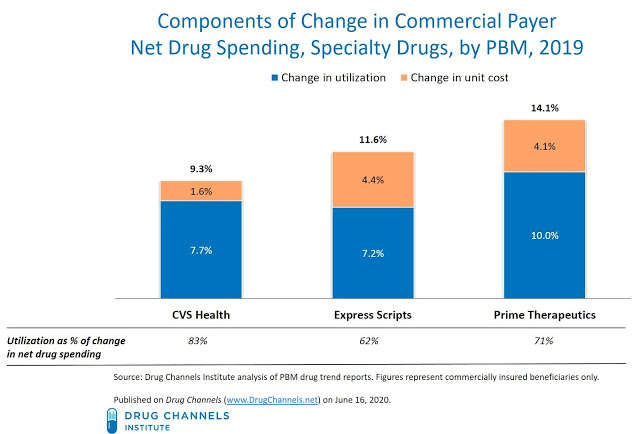

The whole change in spending proven above equals the sum of adjustments in unit price and adjustments in utilization. The chart under deconstructs adjustments in spending on specialty medicine for the three PBMs in our overview.

As you’ll be able to see, a majority of specialty drug spending development may be attributed to the expansion in the variety of individuals being handled and the variety of prescriptions being disbursed. Utilization development may be thought-about a constructive pattern, as a result of it’s effectively established that pharmaceutical spending reduces medical spending and improves sufferers’ well being.

[Click to Enlarge]

Note that the launch of generic variations of non-biologic specialty medicine is working its magic on prices, simply as when conventional brand-name medicine lose exclusivity. Generic medicine account for a significant share of prescriptions in such therapeutic classes as oncology, e.g., imatinib mesylate, anastrozole, tamoxifen citrate, and inflammatory circumstances, e.g., methotrexate, sulfasalazine. Many of those medicine have been topic to the deflationary forces affecting your entire generic business.

Express Scripts supplied essentially the most detailed details about pattern by therapeutic class. Click right here to see its Top 15 remedy lessons for business plans. (You can view the underlying information by clicking the “Show table” button.) As you’ll be able to see, unit price development was in the mid-single-digit vary for 3 main specialty classes—oncology, HIV, and a number of sclerosis. Only one category– inflammatory circumstances—skilled a double-digit improve in unit price pattern.

PIT STOP FOR PRIME

The relative underperformance of Prime Therapeutics is essentially the most putting revelation of the 2019 drug pattern figures.

Here are three causes what I feel Prime lagged behind its bigger PBMs friends:

- Smaller rebates. Prime Therapeutics accounted for under 6% of equal claims in 2019. It merely didn’t have the dimensions to extract the very best rebates from pharmaceutical producers. This lack of leverage translated into greater web costs. For Prime’s business purchasers, web drug costs for conventional medicine declined by solely -3.0%, which is about half of the speed of its two bigger friends.The 2019 outcomes spotlight why Prime determined to align with Express Scripts for formulary rebates and community pharmacy charges. See Express Scripts + Prime Therapeutics: Our Four Takeaways From This Market Changing Deal. Prime now sources formulary rebates through Ascent Health Services, the secretive Switzerland-based group buying group (GPO) that Express Scripts launched in 2019.

- Diverting affected person help funds to plan sponsors. Another distinction: CVS and Express Scripts have every partnered with secretive and impartial personal corporations to function specialty drug maximizer applications for his or her plan sponsor purchasers. These preparations enable the PBMs to shift producers’ affected person help funding to their plan sponsor purchasers. See Why Do CVS And Express Scripts Rely on Secretive Private Companies to Run Their Copay Maximizer Programs?For no matter purpose, Prime has stayed away from these shady practices. Perhaps the 18 Blue Cross and Blue Shield well being plans which have possession stakes in Prime had been reluctant to accomplice with such mysterious corporations.

DON’T LEAVE PATIENTS IN THE DUST

On common, third-party payers and sufferers achieve from the sluggish development in drug spending—particularly in mild of the a lot greater development in different components of the healthcare system. However, sufferers usually face rising out-of-pocket prices for merchandise whose web costs are declining.

As I famous in my overview of economic profit design:

“Patients are finding their benefits to be increasingly mysterious, with more tiers, more coinsurance, and greater use of deductibles. When people complain about ‘drug prices,’ they are actually complaining about the share of costs that they pay—and how those costs are computed.”

You received’t hear this angle in the PBMs’ pattern reviews.